2019 Deloitte and MAPI Smart Factory Study: Capturing Value Along the Digital Journey

Key takeaways

- Smart factory initiatives could potentially ignite stalled labor productivity growth. Study forecasts threefold improvement in labor productivity over the next decade.

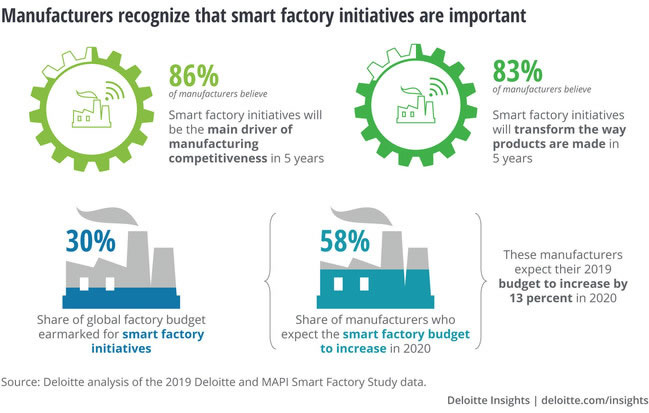

- More than 86% of survey respondents believe smart factory initiatives will be the main driver of manufacturing competitiveness in the next five years, though only 51% are making/have made investments.

- First movers cited having invested as much as 65% of this year's budget on smart facility initiatives and reported twice the level of labor productivity gains compared to peer groups.

Why this matters to the manufacturing industry

In the spring of 2019, Deloitte and the Manufacturer's Alliance for Productivity and Innovation (MAPI) surveyed more than 600 executives at manufacturing companies with headquarters in the United States and a global factory footprint to help quantify the impact of smart factories on key business metrics including manufacturing productivity. Data analysis, economic forecast modeling and executive interviews with manufacturers conclude that smart factory initiatives could be the key to manufacturing competitiveness.

U.S. manufacturers seeking boost in productivity

Although 2011 is considered the unofficial start of the fourth industrial revolution, U.S. manufacturers have reported zero average growth in labor productivity over the past five years — despite continual improvements in equipment, software and management approaches. As the industry grapples with a labor shortage, among other challenges, the study and forecasting model suggests smart factories could be key to boosting stalled labor productivity and unlocking overall productivity gains for manufacturers.

Smart factories provide economic benefits

Smart factory initiatives could lead manufacturers to experience labor productivity increases of 4%, as per the study, which represents a threefold improvement over the past decade's average annual growth rate of 0.7% (2007-2018). Notably by 2030, the compound annual growth rate (CAGR) of U.S. labor productivity is projected to be near 2.3%, a level last seen in the 1990s.

Key quotes

"Smart factory initiatives are delivering on many of the promised benefits of the fourth industrial revolution. Combining digital technologies with the automated solutions of the past is expected to jump-start manufacturing productivity and set a new trajectory of growth for the sector. For companies looking to capitalize on smart manufacturing as a key competitive advantage, now is a crucial time for action."

- Paul Wellener,

vice chairman and U.S. industrial products

and construction leader, Deloitte LLP

"Manufacturing output may be 11% of U.S. gross domestic product, but its total value chain for the economy is three times that. And digital transformation will likely only increase manufacturing's importance and competitiveness. This new research provides excellent insights for manufacturing leaders trying to propel their digitalization journey, regardless of the current state of their operations."

- Stephen Gold,

president and CEO, MAPI

Manufacturers harvesting real business value from smart factories

Implementing smart factory initiatives appears to be paying off for early adopters. Self-identified in the study as "trailblazers" — the group is investing as much as 65% of this fiscal year's budget on smart facility initiatives, which has led to twice the level of gains to labor productivity compared to other peer groups.

Smart factory initiatives are accelerating business value creation. Companies report up to 12% gains in areas like manufacturing output, factory utilization and labor productivity after they invested in smart factory initiatives. Moreover, manufacturers with smart factories will likely surpass traditional factories with 30% higher net labor productivity in 2030, and thus potentially higher profits.

Implementing smart factory initiatives is helping to build resiliency and is often viewed as a competitive advantage. However, while more than 86% of survey respondents believe smart factory technologies will be the main driver of manufacturing competitiveness in the next five years, only 51% of respondents are planning investments or have implemented smart factory initiatives.

Digital providing promising solutions for smart factories

Of those survey respondents who said they were investing in smart manufacturing, quality sensing and detection is cited as the most common smart factory initiative, with approximately 50% of respondents saying it's currently in use. Foundational technologies, such as data analytics, cloud networking, robotics and automation, are well invested (approximately 90% of respondents are currently investing or plan to invest in these technologies), while promising interest is evident in emerging technologies, including active and passive sensors, Internet of Things and vision systems (greater than 80% of respondents are currently or plan to invest in these technologies).

The risks of smart factory adoption

One of the biggest challenges of smart factory adoption identified by respondents is that many organizations simply do not take any action on smart factory investment and initiatives. Nineteen percent of respondents have not thought about smart factory transformation, and 30% are thinking about it but currently not planning any initiatives.

Operational risk was cited as top of mind for manufacturers regarding smart factory initiatives, followed by strategic and financial risks. Additionally, cyber risk was a concern across the board, given its exposure despite digital maturity.

Visit the 2019 Deloitte and MAPI Smart Factory Study landing page to see additional results from the survey and learn more about the research methodology. Connect with us on Twitter at @DeloitteMFG; @MAPI_Mfg_info; @pwellener or on LinkedIn @PaulWellener.

About Deloitte

Deloitte provides industry-leading audit, consulting, tax and advisory services to many of the world's most admired brands, including nearly 90% of the Fortune 500® and more than 5,000 private and middle market companies. Our people work across the industry sectors that drive and shape today's marketplace — delivering measurable and lasting results that help reinforce public trust in our capital markets, inspire clients to see challenges as opportunities to transform and thrive, and help lead the way toward a stronger economy and a healthy society. Deloitte is proud to be part of the largest global professional services network serving our clients in the markets that are most important to them. Our network of member firms in more than 150 countries and territories serves four out of five Fortune Global 500® companies. Learn how Deloitte's approximately 286,000 people make an impact that matters at www.deloitte.com.

About MAPI

Founded in 1933, the Manufacturers Alliance for Productivity and Innovation is a nonprofit organization that connects manufacturing leaders with the ideas they need to make smarter decisions. Its mission is to build strong leadership within manufacturing to drive the growth, profitability, and stature of global manufacturers. mapi.net.

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee ("DTTL"), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as "Deloitte Global") does not provide services to clients. In the United States, Deloitte refers to one or more of the US member firms of DTTL, their related entities that operate using the "Deloitte" name in the United States and their respective affiliates. Certain services may not be available to attest clients under the rules and regulations of public accounting. Please see www.deloitte.com/about to learn more about our global network of member firms.

Comments (0)

This post does not have any comments. Be the first to leave a comment below.

Featured Product